What are "Employee Ownership Trusts"?

A coalition is pushing for federal legislation on Employee Ownership Trusts as a progressive solution for aging business owners. Is it though?

A recent article on TVO about Employee Ownership Trusts caught my attention, because I’m a huge fan of economic democracy, like community land trusts or worker owned co-ops, where people share ownership and economic decision making in their communities. I am convinced it’s a big part of how we can make our communities more equitable and more enjoyable places to live.

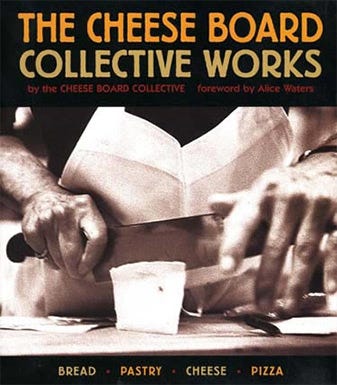

I lived in Berkeley, California for a few years, and it is teeming with worker-owned co-ops along with other forms of employee ownership models. Our favourite place to get pizza, the Cheese Board Collective, has been a worker-owned co-op in Berkeley since 1971 (hence the image choice). That’s not why we liked it - it was affordable, and while there was almost always a line, they usually had live music to make the wait enjoyable. Our second favourite place to get pizza, Zachary’s Chicago Pizza (my partner loves pizza) was also employee owned, but through an Employee Stock Ownership Plan (ESOP).

Anecdotes about pizza aside, I was a recent econ grad at the time, and I was doing some freelance work but still searching for something to focus on that was both interesting to me and would pay the bills. I did some research on the history of co-ops in the Bay Area, talked to the people at Network of Bay Area Worker Co-operatives (NoBAWC - pronounced “No Boss”) about what institutional structures had allowed co-ops to flourish there, and was involved with a group that was trying to find ways to make it easier for worker co-ops to get financing. I didn’t end up publishing any of that research, but I have kept up my interest in understanding and supporting worker ownership models.

So, excitement! Legislation to make it easier for workers to take over ownership of the places they work! Sign me up!

What is CEOC proposing?

I checked out the coalition mentioned in the TVO article, the Canadian Employee Ownership Coalition. They cite all kinds of evidence around the benefits of employee ownership, the need for transition planning for older business owners, etc. Great! But what exactly are they proposing?

The only model of employee ownership mentioned on the site is an Employee Ownership Trust (EOT), based on a model used in the UK. Cool, how do they work? So I google it.

The first response is an ad telling business owners that they can avoid taxes by selling through an ownership trust. Not a great start. But still, maybe worth it?

Nope, it gets worse. It turns out that employee ownership trusts involve no actual employee ownership at all. They don’t even provide improved employee involvement in decision making.

How does it work? The owner sells some or all of the business to a general trust, which is then directed to make decisions in the best interests of all of the enterprise’s employees. There is no requirement that employees have a voice in the decisions of the trust. Trustees (established by the former owner) get to decide what it means for a decision to be in the best interests of employees. Theoretically, an employee could be a trustee, but there’s nothing that even promotes that as an option.

Current employees do share in the profits of the trust, and sharing has to be made in a consistent fashion (based on the number of hours an employee worked that year, for example). Often though, the trust has borrowed money to pay out the selling owner, and so that can affect the amount of profit available to be shared.

It is clear why this model would be attractive to those looking to sell their business. First of all, in the UK there is no capital gains owed on the sale of shares to the trust.

But the benefits of the model go beyond tax avoidance. The US has a version of EOTs that don’t offer any tax break at all. In both the UK and the US the selling owner can maintain a minority share in the business, and can choose to stay on as a decision maker with the trust. This allows a business owner to ease into retirement, while being able to maintain their vision and feel confident that their existing employees won’t be left in the lurch. (All good things, btw).

It’s also clear why EOT legislation would be attractive to accounting and management firms wanting to sell this product to their small business clients. In the UK, firms like Pricewaterhouse Coopers are eager to help with all aspects of setting up an EOT - from a strategic review, to share valuation, or even communicating it to the employees.

The US version, without the tax avoidance piece, seems like a totally fine option to meet the needs of retiring business owners. There may even be benefits to employees of this model over having the enterprise sold to the highest bidder - or not sold at all. But it’s disingenuous to frame it as “employee ownership”, or argue that it should be subsidized through capital gains exemptions. That the Canadian Employee Ownership Coalition are trying to do so raises red flags for me.

What are the claimed benefits of EOTs for Canada?

I looked into the research the CEOC cited under a section that says “Delivering Benefits to Canada’s Economy” to see what it had to say about the benefits of EOTs. This study, and this one, weren’t even about EOTs, but about Employee Stock Ownership Plans (ESOP). That matters, because under an ESOP in the US, employees not only share in profits, they also accumulate a stake in the company while they are working at the company (often without having to purchase it), and have voting rights. When an employee leaves the business, the value of the shares they have accumulated is paid out to them from the ESOP. There is no such mechanism for building employee wealth within the UK profit-sharing EOT model.

Now I’m annoyed that they’re using evidence about apples to sell oranges, so I’m gonna check all the links.

This page that they link to about the number of US employee-owners is from the US based National Centre for Employee Ownership. It is mostly about ESOPs, but also mentions other forms of (actual) employee ownership, such as worker co-ops, equity grants (where employees receive stock ownership as part of their compensation), and employee stock purchase plans. It includes no information on EOTs.

They state that some US employee-owners retire with $1M+ payouts. Guess what, once again, this statistic has nothing to do with EOTs. It is referencing forms of employee ownership where, hey!, employees actually accumulate an ownership stake in the company they work for, and are paid out the value of that share when they retire. I’m going to repeat this, but there is no way to build employee wealth in this manner through the UK or US EOT model.

a reference on employee-owned businesses growing faster is based on, guess what, ESOPs. It was not hard to establish this, as it was in the title of the paper - “Firm Survival and Performance in Privately Held ESOP Companies”.

a reference on employee-owned businesses being more profitable is a meta-analysis that looks at outcomes from firms that offer different types of stock ownership and stock option plans. Again, no EOTs included here, no ESOPs either.

a reference on employee-owned businesses being more resiliant defines employee ownership as direct employee ownership (or claim on) stock, which excludes EOTs.

a reference to employee-owned firms out-performing other companies through the pandemic is from the ESOP Foundation and Rutgers University, which confined their research to majority-owned ESOP firms.

On careful reading, nothing in the “Benefits to Canada’s Economy” section claims to be about EOTs. But you’d be forgiven for thinking that it was, since establishing EOTs with the same tax benefits as the UK model is the sole recommendation of this group (it’s a four-part recommendation, here). They also use flawed transitive logic to lead readers to that conclusion - they claim that EOTs are a form of employee-ownership, and these studies are also about employee-ownership, so the implication is that whatever holds true about a) must also hold true about b).

There are important structural differences between a trust that makes decisions on behalf of employees and shares some of the profits, and models that actually enable employees to own stock in the company, let alone participate in decision making. We simply can’t draw any conclusions about which (if any) benefits of employee ownership might be shared by an EOT. Given the careful language on the CEOC website, I would hazard a guess that they know that too.

UPDATE - apparently some of the coalition members are advocating for an ESOP-style model, but didn’t feel the need to clarify that on their website. After our conversation where I explained why I thought it was misleading not to, they might. One is left wondering why this coalition is not recommending an ESOP-style model, given the breadth of data about their benefits and the paucity of data about the benefits of EOTs. ESOPs in the US also have tax advantages for owners who are selling their businesses, but with, again, actual employee ownership at the end of the day. I’m sure they’ll say ESOPs are more complicated to set up, and the fact that the business has to buy shares back from exiting employees can be a challenge, which is true. But if you like the outcomes of that model, I question why you’re advocating for a very different kind of model. Can I trust that you actually care about any of those outcomes you’re talking about?

(ESOPs aren’t even my fav - I’m just saying they’re better than EOTs).

Will it be in Budget 2023?

There are some heavy-hitters on the “supporters” page of CEOC site. The existence of the webpage and the TVO story, though, tell me that it’s not a done deal - they’re still trying to sell it to us normies.

Finding a way to help small business owners transition their businesses as they retire is a very good idea. Enabling employee ownership as part of that transition would be even better.

Subsidizing a scheme that doesn’t provide ownership or voice to workers? Not great, not progressive, probably not even good for Canada’s economy or inequality once you factor in the effects of the capital gains tax break. I really hope our Finance Minister agrees.

UPDATE: After an extended and mostly civil twitter convo, some of the steering committee members have clarified that they are asking for either a UK EOT profit-sharing model OR something more like the US ESOP model. They consider “trust ownership on behalf of employees” to be equivalent to “employee ownership”, and so did not feel the need to differentiate. My concerns about conflating the benefits of the two remain, as do my concerns about implementation of either of these models being beneficial enough to warrant a tax break. A trust model without the tax break, that builds worker wealth and incorporates workers into decision making would be perfectly fine.